Coronavirus Bankruptcy

How global health can affect your finances

The Coronavirus outbreak has become a strong reminder that, regardless of your own health or financial stability, national and global crises can directly and indirectly affect your finances.

Companies across all industries have experienced reduced revenues and cash-flows due to global travel bans, social distancing policies and essential service restrictions that prevent certain businesses from operating.

With a drastic reduction in tourism and local population movement, plus reduced business activity as companies protect their financial stability, these elements have resulted in loss of employment and client bases, and may have forced you into a position where you are no longer able to pay off debts.

If you find yourself in this position, you may need to consider declaring bankruptcy.

How Coronavirus could contribute to increased bankruptcy rates

Impacts of COVID-19

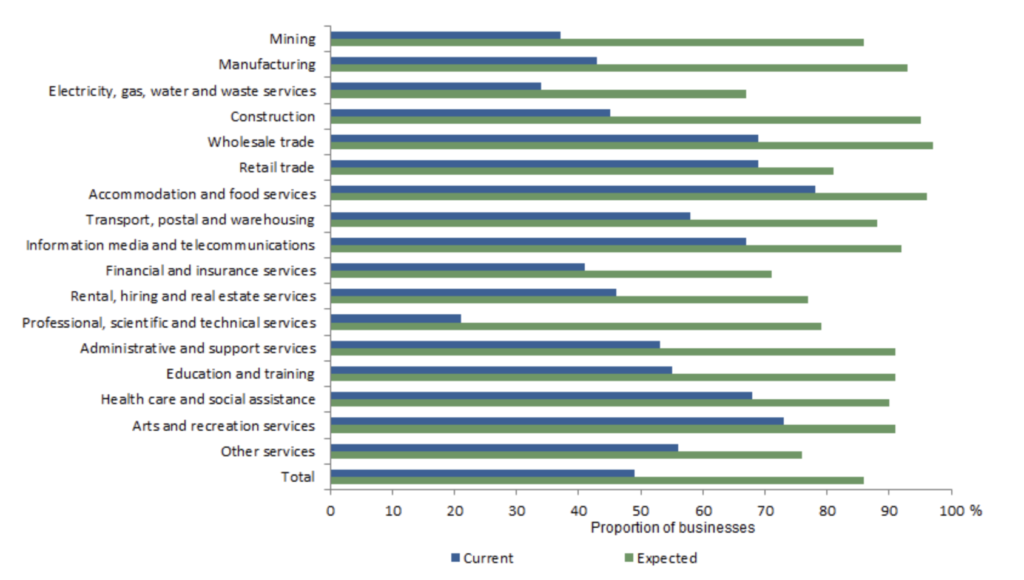

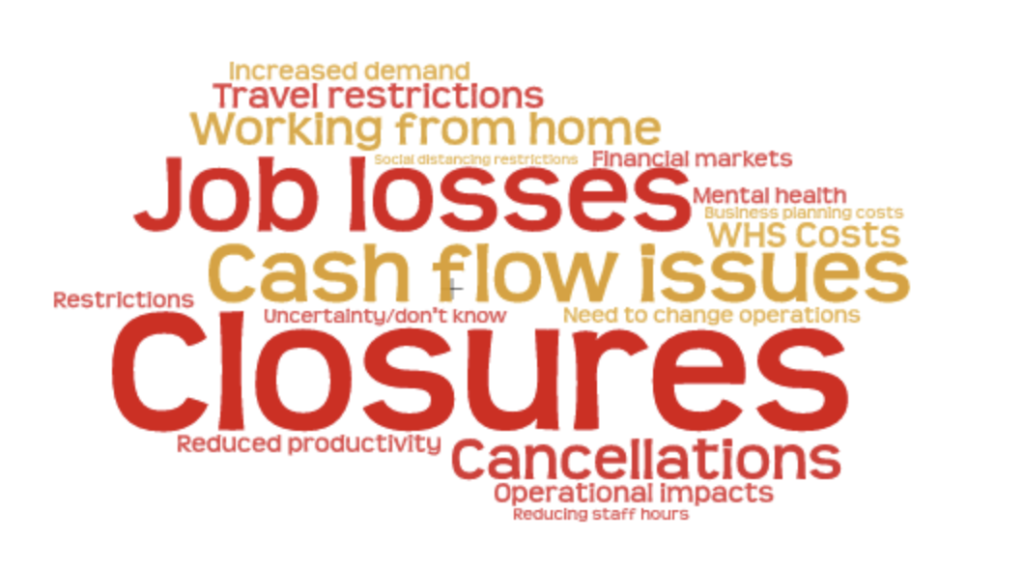

Since March 2020, businesses across Australia have felt increasing pressure as a result of COVID-19. To get a sense of the national impact of COVID-19, the Australian Bureau of Statistics surveyed 3,000 businesses and found that almost half of the Australian businesses surveyed (49%) had been affected…and this was reportedly before the Australian Government’s announcement of Phase 1 Social Distancing Measures.

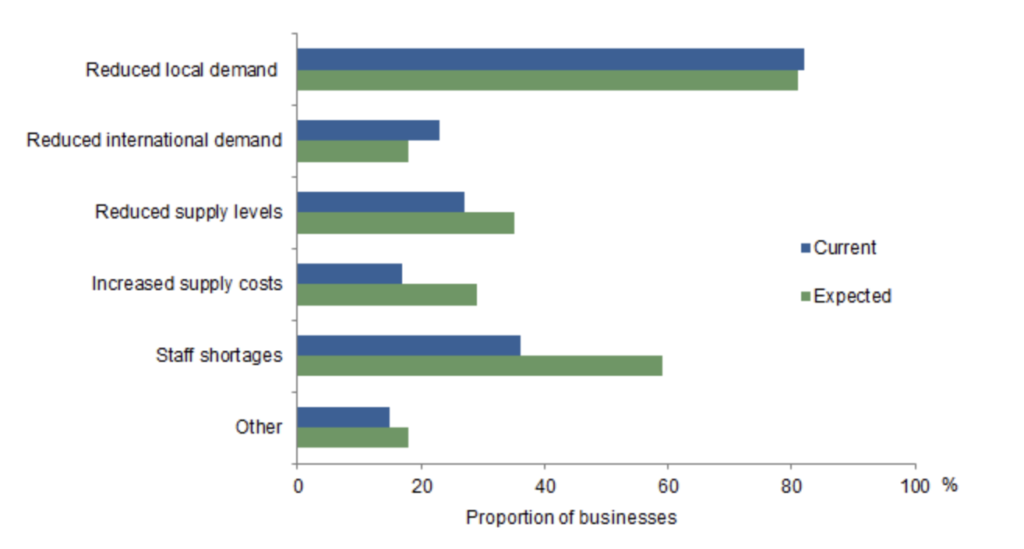

Adverse impacts of the pandemic include reductions in local demand, which was the most common impact (82%) experienced as a direct result of non-essential travel restrictions and social distancing which was introduced to help ‘flatten the curve’ and limit the virus’ spread across the country.

Since March, more than a third of affected businesses also experienced staff shortages (36%). Due to the ongoing travel and interaction restrictions, 59% of businesses expected to experience staff shortages in coming months.

The ongoing pandemic

Cash flow has become an increasing issue for businesses as the pandemic forces new behaviours. Without a consistent stream of customer spending, or new projects or client contracts, two thirds (66%) of Australian businesses reported that their turnover or cash flow had reduced.

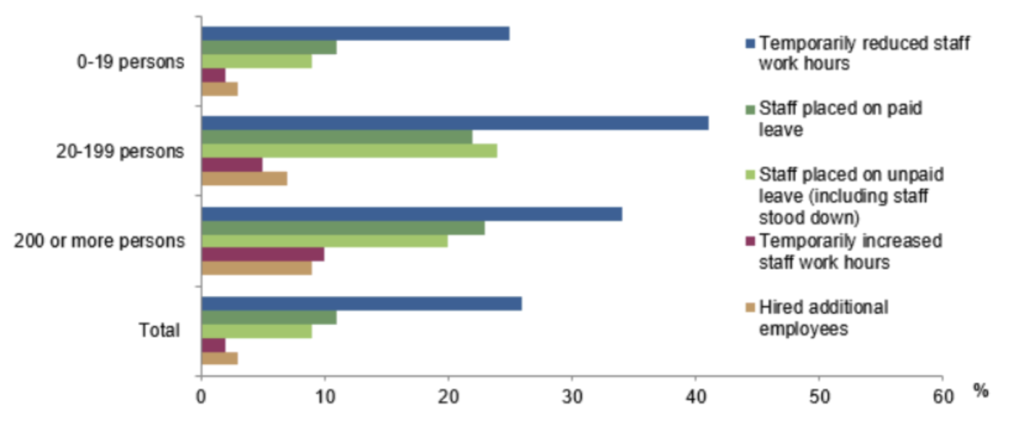

When cash flow is reduced, many businesses find it difficult to maintain a steady rate of operations. Nearly half of businesses (47%) have been forced to make changes to their workforce arrangements as a result of COVID-19. These arrangements include:

- Temporarily reducing or increasing staff working hours

- Changing the location where staff worked (including working from home)

- Placing staff on leave.

Many businesses have also been forced to restructure their business model to stay afloat. Two in five businesses (38%) have changed how they deliver their products or services, including shifting to online services, and over a third of businesses have renegotiated their lease and rental arrangements and a quarter have deferred loan repayments.

Looking ahead – potential bankruptcy in the wake of COVID-19

Restrictions have begun to ease in several states and many politicians across Australia, at both state and federal levels, are looking to the future to gauge when activity can gradually reach a point of pre-COVID-19 familiarity.

Slowly but surely, life is expected to return to normal. However, there are many workers and business owners who were restricted by the need to flatten the curve of the pandemic spread, which meant self-isolation and restrictions on travel and non-essential retail. The lack of cash flow against the unsympathetically constant stream of bills and other expenses and caused debt to rise, leaving many with a growing inability to recover financially after the pandemic.

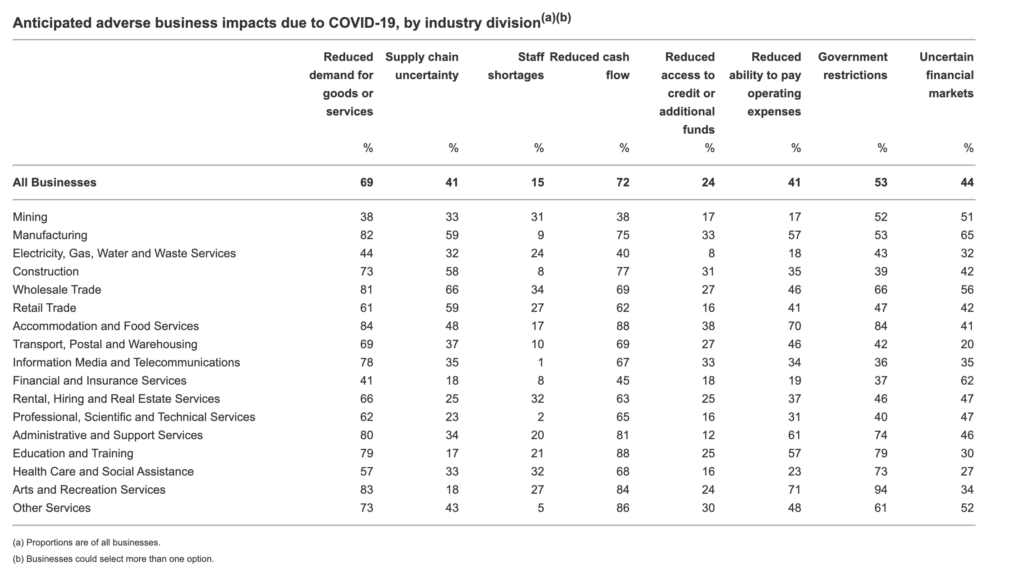

The ABS said that almost three quarters of Australian businesses (72%) reported that reduced cash flow is expected to have an adverse impact on business over the next several months. Reduced demand for goods and services was expected to impact about seven in ten businesses (69%), while two in five businesses (41%) could face significant challenges in paying operating expenses. This could lead, in the long term, to inescapable debt that may lead many to seek out bankruptcy and personal insolvency options.

All data, graphs and statistics were sourced from the Australian Bureau of Statistics and its range of existing and ongoing statistical products produced exclusively to measure the impacts of COVID-19.

What happens if Coronavirus leads me to bankruptcy?

If the pandemic has led you into a declining financial situation resulting from debts and arrears that you are unable to pay, the solution may be to file for bankruptcy.

This can be done lodging a debtor’s petition and a Statement of Affairs to ITSA, or getting an appointed private trustee to do so on your behalf. You may also receive a court order that you go bankrupt, as a result of a ‘Creditors petition’ filed by someone who claims they are waiting for unpaid debts.

However, as a result of the ongoing effects since the initial Coronavirus outbreak, new temporary bankruptcy laws were introduced by the Australian Government to alleviate financial pressure through greater bankruptcy thresholds and lighter process deadlines.

Find out more about the new temporary bankruptcy laws.

Should the economic effects of Coronavirus cause you to face bankruptcy, it is important to speak to one of the professional insolvency experts at Insolvency Guardian for more information about your situation and your options.