If you have a higher education debt, chances are it could affect how much you could borrow for a home loan.

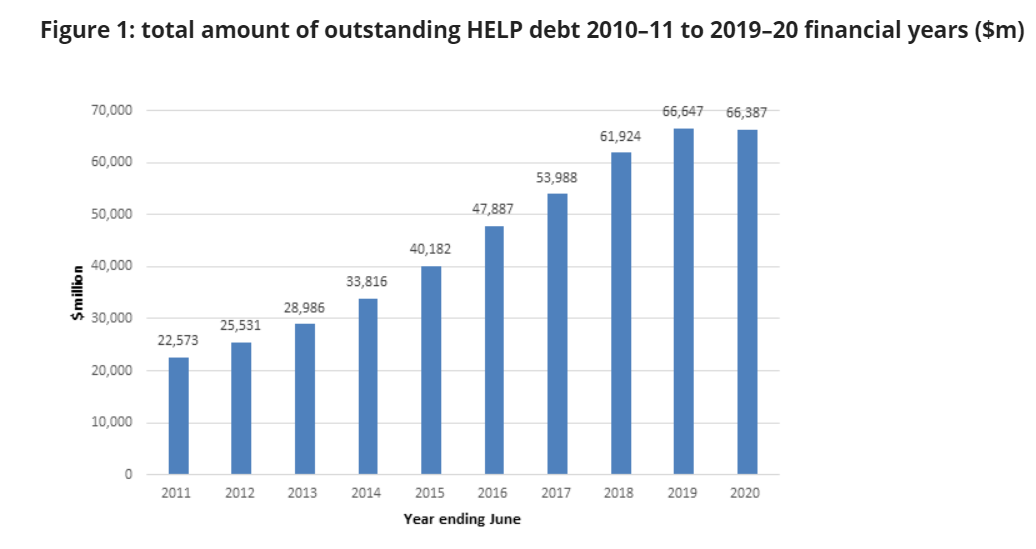

There are a lot of people with a lot of Higher Education Loan Program (HELP) and Higher Education Contribution Scheme (HECS) debt in Australia. According to the Australian Tax Office (ATO), there were 2.9 million people with outstanding HELP debts in the 2019/20 financial year – totalling nearly $66.4 billion. The average debt was $23,280, with 24,544 people having debt in excess of $100,001.

Source: ATO

If you want to buy a property, a HELP debt could minimise your borrowing power. Find out why, by how much, and what steps to take moving forward.

What is HELP debt?

HELP is a government subsidised loan program, encompassing HE…

Read the full article at: https://www.savings.com.au/home-loans/do-hecs-help-debts-affect-your-home-loan-borrowing-power